Key Takeaways

- Manhattan studio rents have climbed steadily and are now averaging $4,050+, with signs of peaking in summer 2025.

- 1B1B units peaked around $5,300+ in early summer and have begun a mild seasonal softening heading into late 2025.

- 2B2B rents reached $7,800+ at peak and are now showing a clear downward adjustment, following historical seasonality.

- Studio leases are best timed in late fall to winter to avoid peak pricing, while 1B1B and 2B2B renters may find deals during early fall softening.

- Overall demand remains strong near subway-accessible zones like Midtown and FiDi, but price sensitivity is growing for larger units.

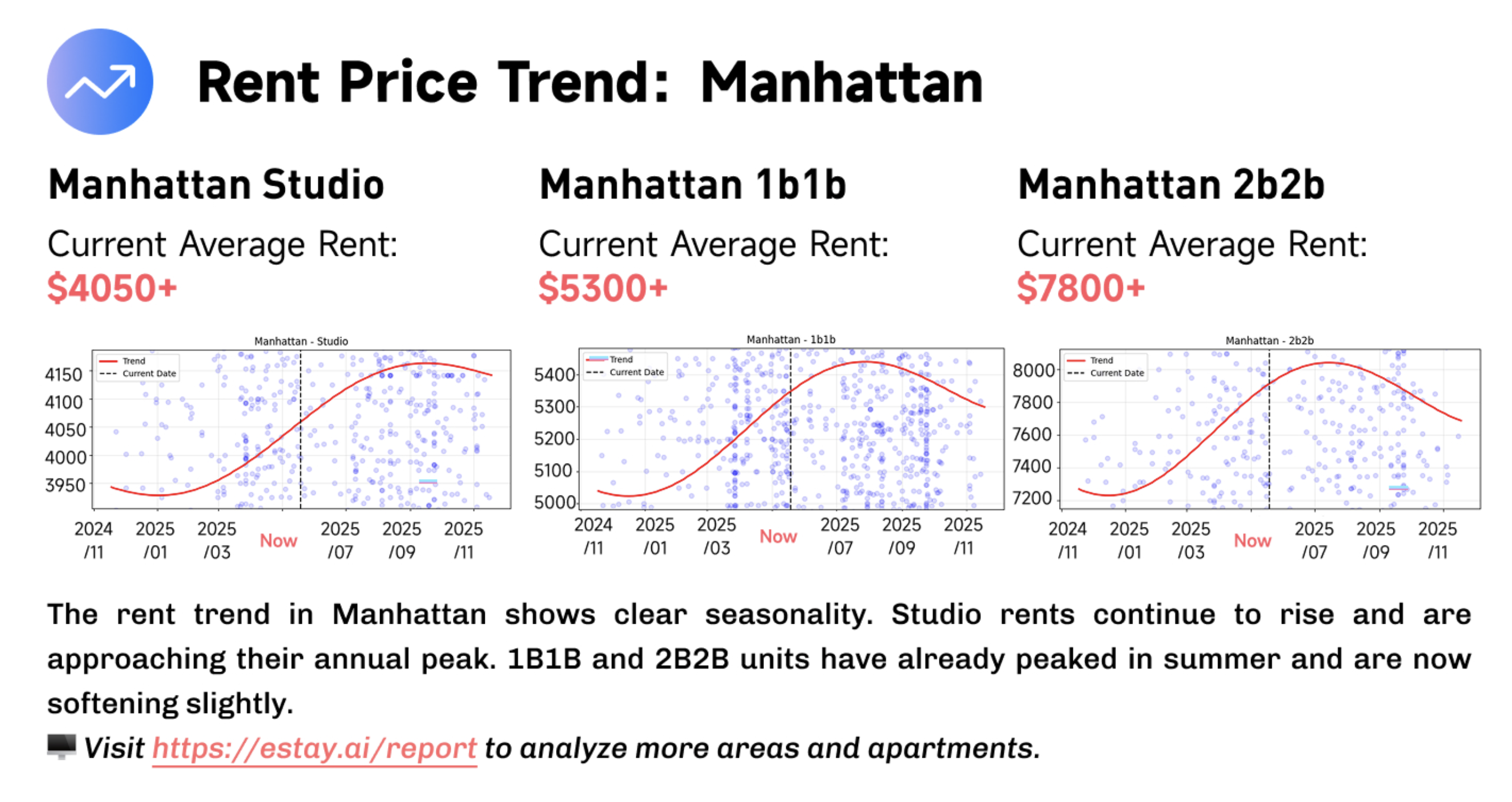

Rent Trends in Manhattan (Updated May 2025)

Rental prices in Manhattan continue to follow a well-defined seasonal rhythm. Studios are still on the rise, nearing their cyclical peak of $4,050+, while larger units — particularly 2B2Bs — have already peaked and are softening slightly as of May 2025. Based on scatter trend analysis:

- Studios: From a low point around $3,950 in late 2024, average rents have risen consistently to over $4,050, expected to peak in early summer 2025.

- 1B1B: Peaked at approximately $5,300 around June–July 2025, now showing slight correction. High commuter demand continues to support prices in Midtown and UWS.

- 2B2B: Hit a high of $7,800+ and are now trending downward, aligning with expected fall softening. Leasing flexibility and unit availability are improving.

Overview Rent Trends in Manhattan (Updated May 2025)

Rental prices in Manhattan continue to follow a well-defined seasonal rhythm. Studios are still on the rise, nearing their cyclical peak of $4,050+, while larger units — particularly 2B2Bs — have already peaked and are softening slightly as of May 2025. Based on scatter trend analysis:

- Studios: From a low point around $3,950 in late 2024, average rents have risen consistently to over $4,050, expected to peak in early summer 2025.

- 1B1B: Peaked at approximately $5,300 around June–July 2025, now showing slight correction. High commuter demand continues to support prices in Midtown and UWS.

- 2B2B: Hit a high of $7,800+ and are now trending downward, aligning with expected fall softening. Leasing flexibility and unit availability are improving.

Manhattan Studio: Trend Report

Studio rents in Manhattan have shown a consistent upward trajectory throughout late 2024 and into mid-2025. As of May 2025, average rents exceed $4,050, approaching their projected seasonal peak. This steady climb reflects high demand from single professionals, students, and remote workers seeking centrally located, compact living options. The price curve indicates a gradual incline starting in early 2025, with the steepest growth between March and July. Renters interested in studios should consider locking in leases before the peak hits in early summer, or wait until the winter months to take advantage of expected seasonal discounts.

Manhattan 1B1B: Trend Report

The 1B1B rental market in Manhattan has reached its seasonal peak, with current average rents over $5,300. The strongest growth occurred between January and June 2025, driven by demand from couples and professionals seeking work-from-home flexibility. However, recent trends show a mild softening beginning in late summer, consistent with historical seasonality. The downward curve suggests that those with flexible timelines may benefit from waiting until fall to secure better rates. Despite the dip, demand remains stable in neighborhoods with strong transit access like Midtown, Lower East Side, and Upper West Side.

Manhattan 2B2B: Trend Report

Two-bedroom, two-bath (2B2B) apartments in Manhattan remain the priciest among all unit types, with peak rents hitting over $7,800 in mid-2025. These units cater to families, roommates, and tenants seeking larger spaces with privacy, and their prices surged through early 2025. However, by May 2025, a clear downward trend has emerged, signaling the beginning of seasonal softening. Renters targeting 2B2Bs may find improved negotiating power through fall and winter, especially in luxury buildings or riverfront properties. Larger layouts are increasingly affected by affordability concerns, leading to more concessions and flexible terms.

How to Find Verified No-Fee Apartments

While "no fee" labels remain popular in marketing, many listings include hidden costs or are outdated. Instead of relying on third-party sites, renters should consider AI-powered tools that pull live availability directly from buildings, ensuring accuracy and avoiding broker markups.

Final Thoughts

As we move into peak leasing season, Manhattan rents — especially for studios — continue to rise. However, 1B1B and 2B2B units are beginning to soften slightly, presenting a good opportunity for flexible renters. Whether you're budgeting for value or targeting skyline views, understanding the timing of seasonal cycles is key.