NYC/NJ Estay AI Assistant – Smart Leasing Tools for Manhattan

Manhattan's rental market continues to demonstrate resilience and strategic adaptation as summer reaches its peak leasing period. Estay AI utilizes comprehensive data analytics, promotional intelligence, and building performance tracking to provide renters with strategic insights for navigating Manhattan's competitive landscape. This week's comprehensive analysis includes special rental offers across Manhattan, detailed rent price trend analysis by unit type, comparative building pricing metrics, and an in-depth spotlight on Sky. Our AI platform empowers renters to make informed decisions during this critical summer leasing window.

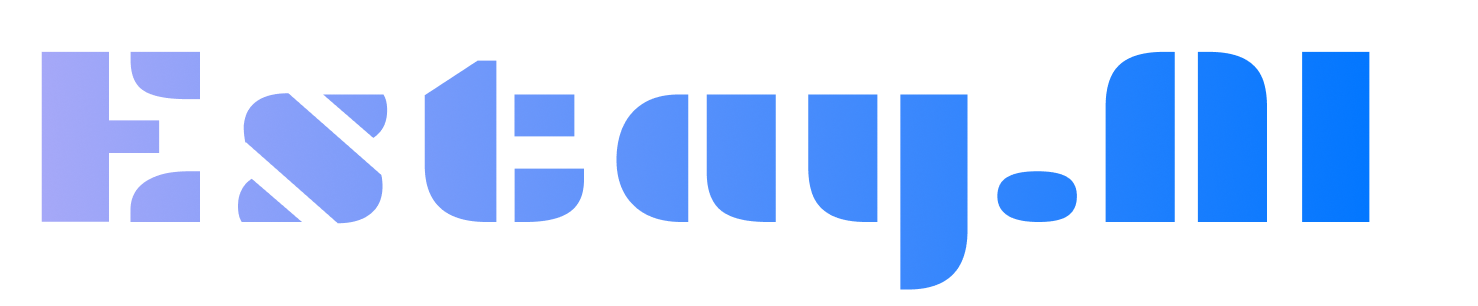

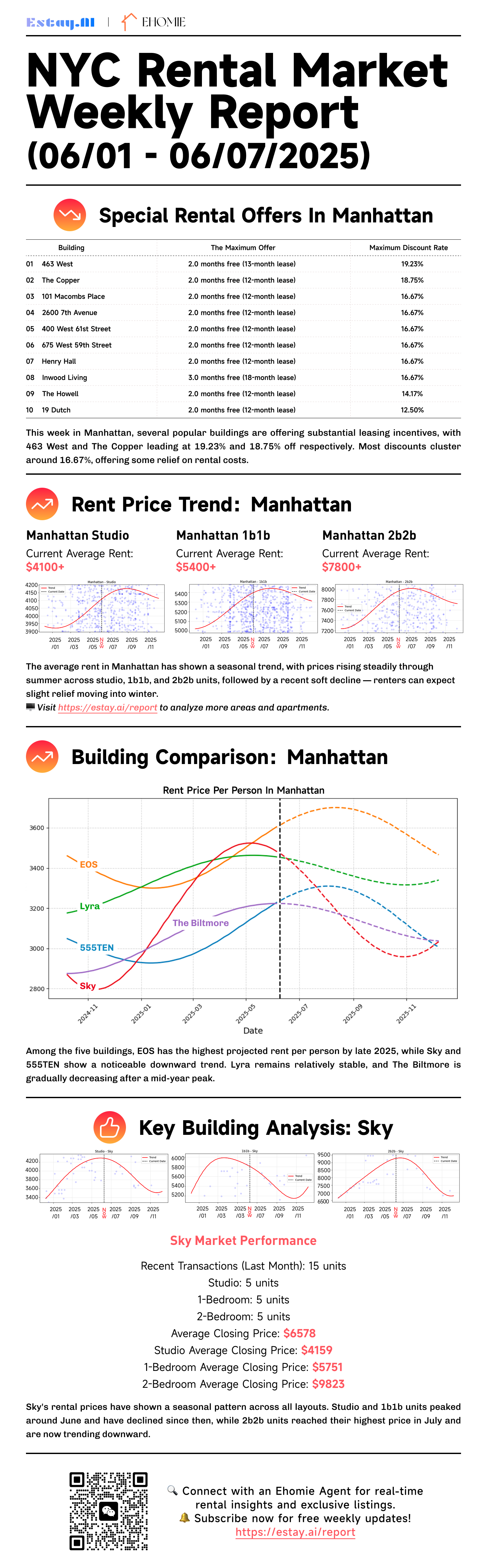

Special Rental Offers in Manhattan – AI Analysis

This week, Estay AI tracked substantial promotional activity throughout Manhattan, with most buildings offering 2 months free on 12-14 month leases, resulting in effective discount rates clustering around 16.67%. 463 West stands out offering 2.5 months free on a 13-month lease, resulting in the highest discount of 19.23%.

Several buildings offer competitive 16.67% discounts through strategic lease structuring:

2600 7th Avenue: 16.67% discount (2 months free, 12-month lease)

420 West 42nd Street: 16.67% discount (2 months free, 12-month lease)

675 West 59th Street: 16.67% discount (2 months free, 12-month lease)

Forty Six Fifty: 16.67% discount (3 months free, 18-month lease)

Innovo Living: 16.67% discount (3 months free, 18-month lease)

Sunrise Tower: 16.67% discount (2 months free, 12-month lease)

The Copper: 16.67% discount (3 months free, 18-month lease)

19Dutch: 12.50% discount (2 months free, 16-month lease)

AI Recommendation: This week's Manhattan promotional offerings present the most competitive concession environment among the listings. Making the most comprehensive set of incentives—this is an exceptional opportunity to secure premium Manhattan apartments with substantial effective rent reductions across multiple top-tier buildings.

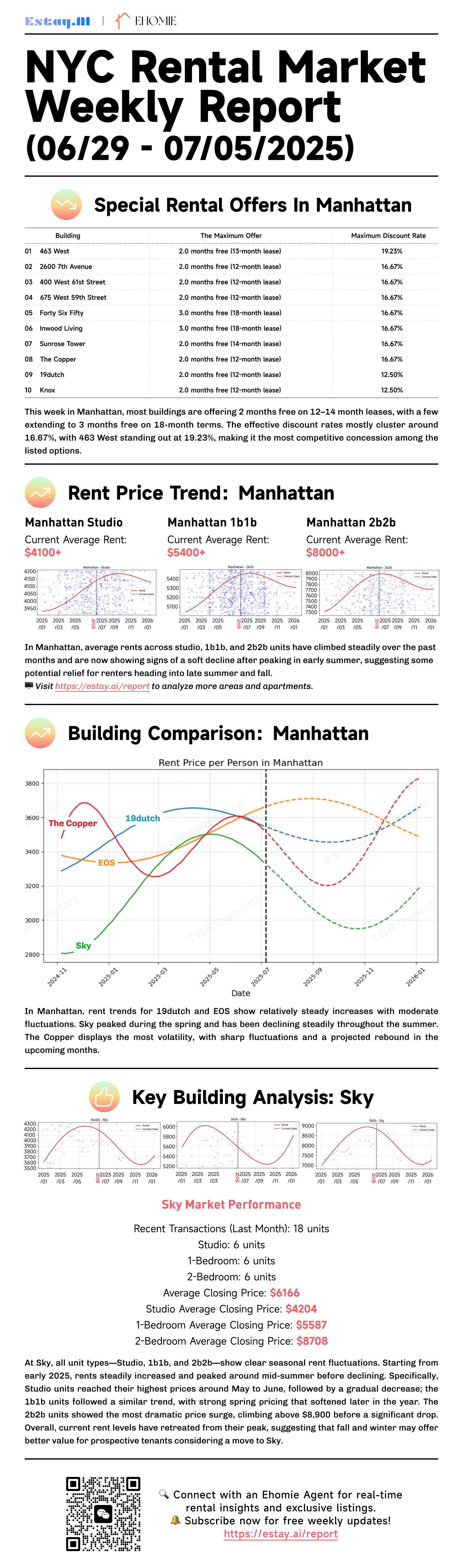

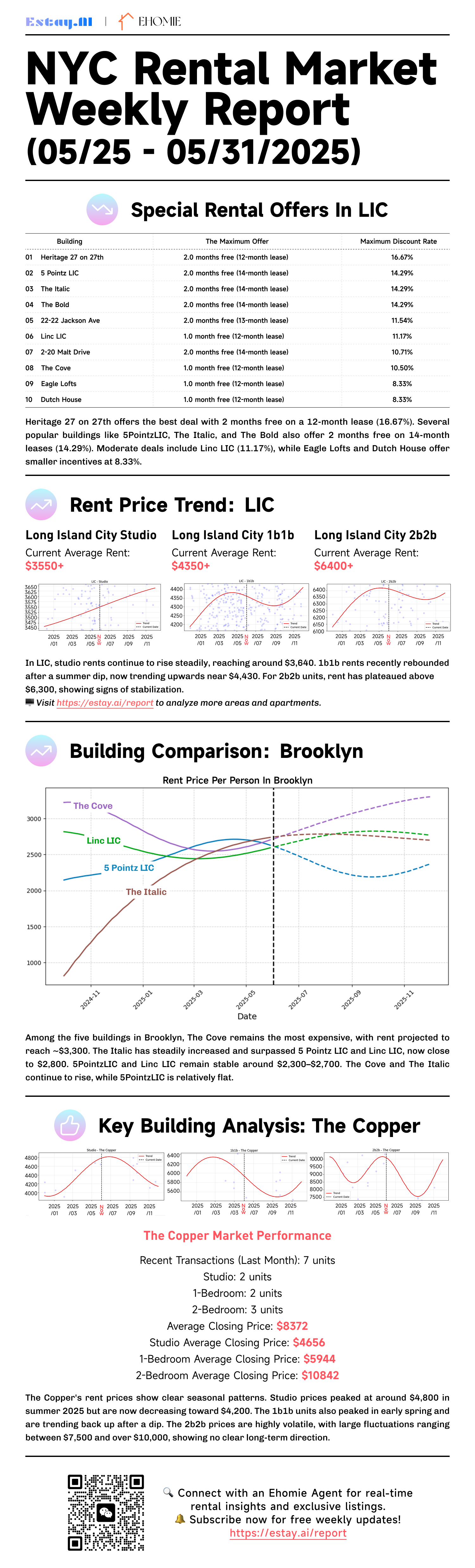

Rent Price Trend – Manhattan – AI Powered Insights

Estay AI reports current average rents in Manhattan as follows:

- Studio: $4,100+

- 1B1B: $5,400+

- 2B2B: $7,800+

In Manhattan, average rents across studio, 1b1b, and 2b2b units have climbed steadily over the past months and are now showing signs of a soft decline after peaking in early summer, suggesting some potential relief for renters heading into fall and winter. This suggests some potential relief for renters needing to sign into summer and fall.

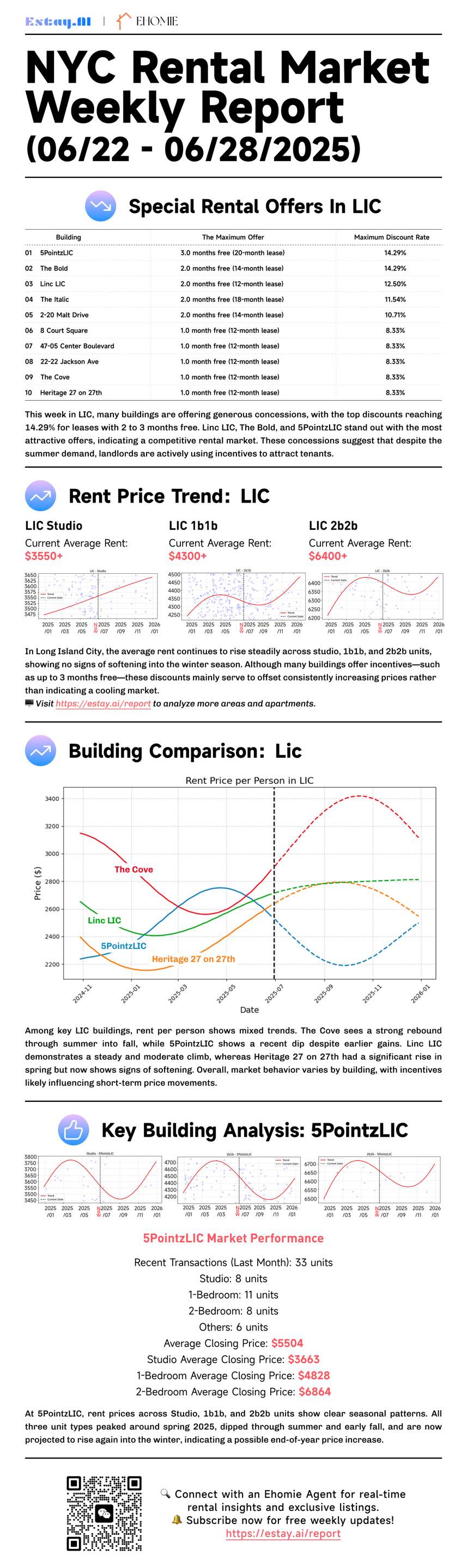

Building Comparison – AI Analyzed Price-Value Metrics

According to Estay AI's per-person rent analysis for Manhattan buildings:

18Dutch and EQS show relatively steady increases with moderate fluctuations, indicating stable premiums markets.

Sky peaked during the spring and has been declining steadily throughout the summer. The Copper displays the most volatility, with sharp fluctuations and a projected rebound in the upcoming months.

In Manhattan, rent trends for 18Dutch and EQS show relatively steady increases with moderate fluctuations. Sky peaked during the spring and has been declining steadily throughout the summer. The Copper displays the most volatility, with sharp fluctuations and a projected rebound in the upcoming months.

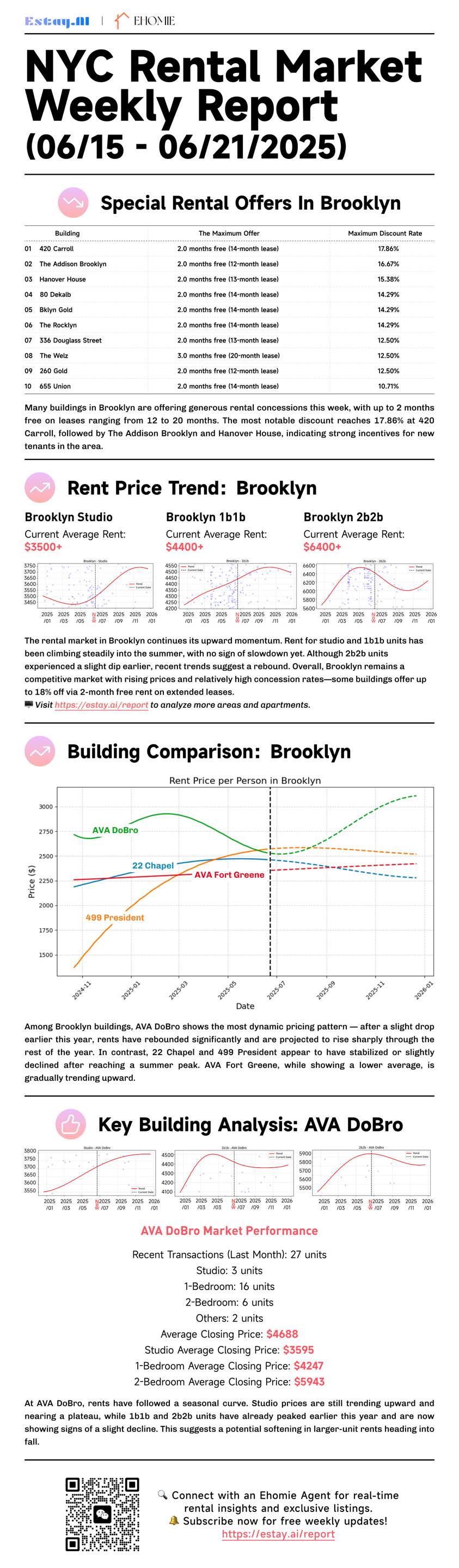

Key Building Analysis: Sky – AI Recommendations

Estay AI highlights Sky as this week's featured building, noted for consistent transaction volume and strategic pricing adjustments across all unit types.

Recent Transactions (Last Month): 18 units

- Studio: 6 units

- 1-Bedroom: 6 units

- 2-Bedroom: 6 units

Average Closing Price: $6166

- Studio Average Closing Price: $4204

- 1-Bedroom Average Closing Price: $5587

- 2-Bedroom Average Closing Price: $8708

AI Insights:

- At Sky, all unit types — Studio, 1b1b, and 2b2b — show clear seasonal fluctuations

Starting from early 2025, rents steadily increased and peaked around mid-summer before declining. Specifically, Studio units reached around $5,500 before falling to current mid-season pricing. The 1b1b and 2b2b units followed a similar curve, with 2b2b units experiencing the most dramatic price surge into mid-summer. The current rent levels have retreated from their peak, suggesting a potential end-of-year rebound or continued softening through fall depending on seasonal demand patterns.

Highlight: Sky presents excellent value timing during the current market correction, with all unit types showing significant declines from summer peaks, creating optimal opportunities for renters seeking premium Manhattan amenities at post-peak pricing during the current transitional period.

How NYC Rent AI Can Help You Find Your Perfect Manhattan Apartment

Our NYC/NJ Estay AI Assistant employs cutting-edge artificial intelligence to analyze thousands of Manhattan rental listings, comprehensive pricing history, building performance data, and promotional campaigns to help you identify the perfect Manhattan apartment.

Beyond traditional search platforms, our AI understands your unique lifestyle needs, budget parameters, and location priorities — delivering real-time, personalized apartment recommendations specifically calibrated to Manhattan's diverse neighborhoods and building types.

Whether you're seeking a luxury high-rise in Midtown with stunning city views, a historic pre-war apartment on the Upper West Side, a modern development in the Financial District, or a trendy loft in SoHo, Estay AI navigates Manhattan's complex rental ecosystem to surface the best opportunities and exclusive deals that conventional platforms frequently overlook.

NYC Rent AI FAQ:

Q: How does NYC/NJ Estay AI personalize apartment recommendations for Manhattan?

A: NYC/NJ Estay AI analyzes recent transactions, building trends, rent movement, and available incentives to recommend listings that best match your location, budget, and layout preferences across Manhattan's premium neighborhoods and diverse building portfolio.

Q: Can the AI help me identify buildings with strong value in Manhattan?

A: Yes. Buildings like Sky are currently experiencing post-peak pricing corrections with significant declines from summer highs across all unit types, offering excellent value opportunities for renters seeking premium Manhattan amenities at more accessible price points.

Q: How frequently is this Manhattan data updated?

A: Weekly. All information is drawn from real-time listings and confirmed rental transactions to ensure accurate and timely insights about the Manhattan rental market.

Summary

This week, the Manhattan rental market demonstrates exceptional promotional activity and post-peak pricing adjustments:

- Studio rents reached $4,100+, showing signs of seasonal correction after early summer peaks

- 1B1B rents peaked at $5,400+ with evidence of softening pricing pressure

- 2B2B rents hit $7,800+ but are experiencing gradual post-peak adjustment

- Promotional offers are extensive, leading to effective rent savings of 12-19%

Estay AI Weekly Picks:

- Renters targeting maximum savings should prioritize 463 West for the highest 19.23% discount rate

- Sky offers exceptional value timing during current post-peak pricing correction across all unit types

- Multiple buildings offering 16.67% discounts provide strong choices and competitive leverage for negotiations

To learn more about real-time rental trends, personalized recommendations, and Manhattan-specific insights, visit Estay.ai and chat with our AI assistant.

Stay informed. Think smart. Let AI help you rent smarter.