Manhattan Rental Market Overview - AI Analysis

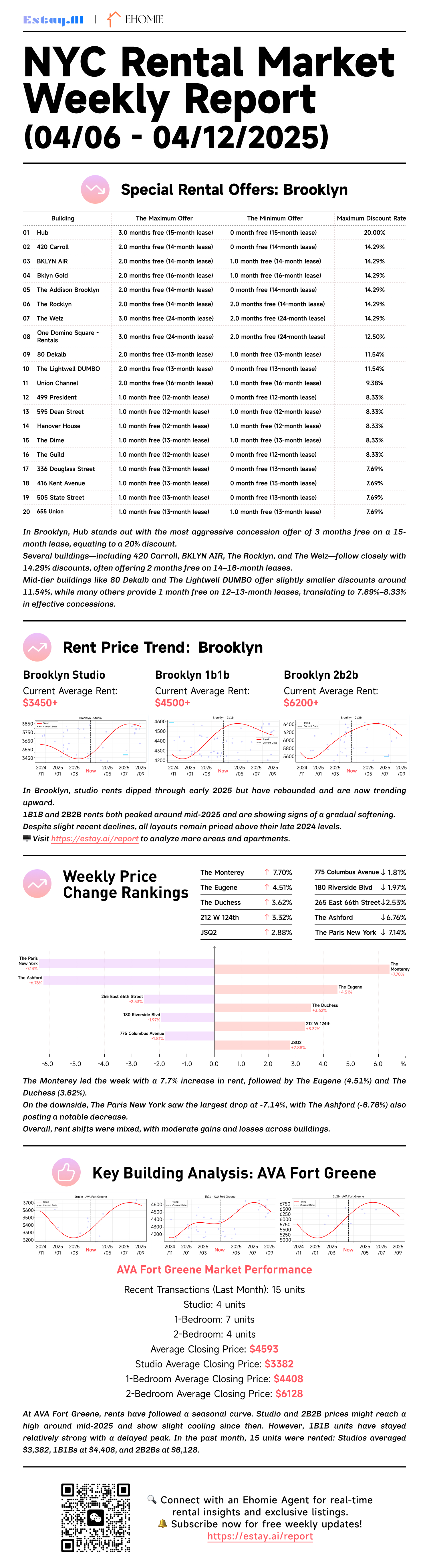

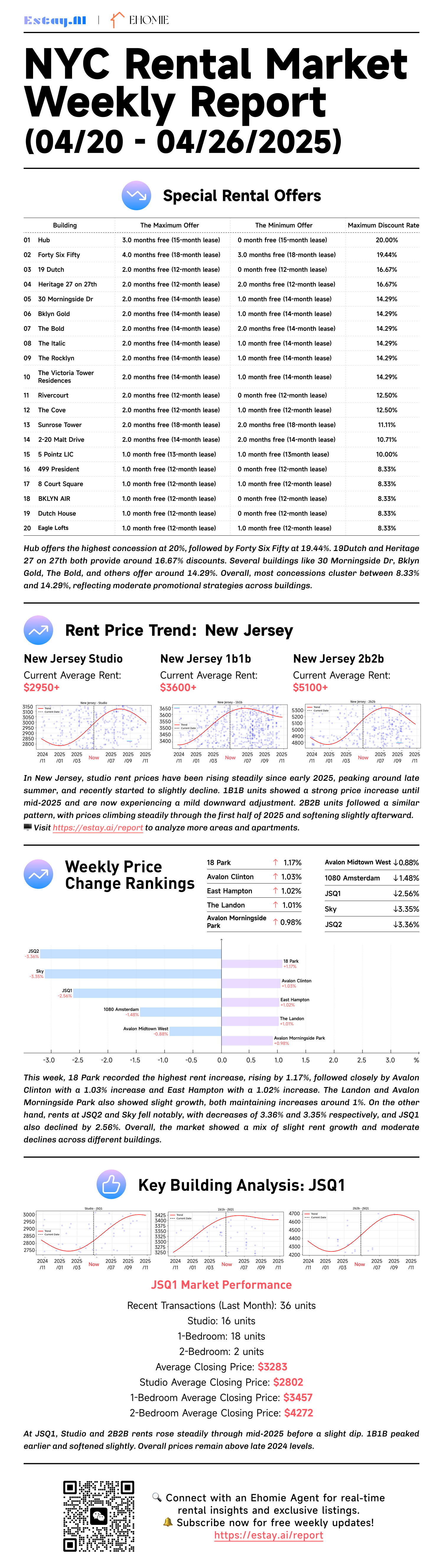

The Manhattan rental market continues to offer attractive concessions this week, with our AI rental analysis identifying Forty Six Fifty and The Copper topping Manhattan's concession rankings, offering rent discounts of 18.84% and 18.75% respectively. 190Dutch also provides a strong 18.67% incentive. Several premium buildings in prime Manhattan locations including 20 Morningside Dr, Sky, and Sunrise Tower are maintaining competitive offers between 14-16% discounts, often through 2 months free on 14-month leases. Mid-tier buildings like 21 West End Avenue and Herald Towers provide more moderate incentives around 8.33%, while many luxury properties maintain a standard 1 month free on 12-month leases, translating to 8.33% effective discounts.

NYC Rent AI Market Highlight: Forty Six Fifty and The Copper lead Manhattan's concession rankings, offering rent discounts of 18.84% and 18.75% respectively. Our AI analysis shows these aggressive incentives are strategically targeting the luxury market segment as Manhattan continues to maintain some of the highest average rental prices in NYC, creating targeted opportunities for renters seeking premium apartments with significant savings.

Manhattan Price Trend Analysis - AI Powered Insights

Our NYC Rent AI has analyzed rental trends in Manhattan, revealing distinct patterns across apartment types:

- Manhattan Studio: Current average rent is $6,000+

- Manhattan 1b1b: Current average rent is $8,200+

- Manhattan 2b2b: Current average rent is $7,800+

In Manhattan, rental prices for all unit types (Studio, 1B1B, and 2B2B) have followed a rising trend since early 2025, peaking during the summer. Recently, prices have shown signs of a slight decline but still remain higher than their late 2024 levels. Demand appears strong across layouts, especially for 2B2B units which had the highest average price level. Our AI analysis indicates this pattern follows Manhattan's typical seasonal rental cycle, with the recent softening potentially offering a small window of opportunity for renters before the market stabilizes again.

Manhattan Weekly Price Change Rankings - AI Tracked

The Eugene led this week's rent increases with a 2.80% rise, followed by Atlantic (2.09%) and Pacific (1.98%). Other notable gainers include Avalon Morningside Park at 1.85%, 21 West End Avenue at 2.79%, and 18 Park at 3.58%. Conversely, 1080 Amsterdam saw the largest drop at -3.61%, with 18 Park (-3.38%) and 21 West End Avenue (-2.78%) also experiencing decreases. Overall, rent changes were modest, with a slight upward tilt in select buildings. The Eugene's consistent performance and Forty Six Fifty's substantial 2.53% increase signal continued strength in Manhattan's prime locations, while the varied performance across buildings indicates a nuanced market with opportunities in specific properties.

Manhattan Key Building Analysis - AI Recommendations

Our NYC Rent AI has identified Sky as a standout performer in the Manhattan market. Recent transactions (Last Month) show significant activity with 24 units: Studio: 9 units, 1-Bedroom: 7 units, and 2-Bedroom: 8 units. The average closing price across all units was $6,211, with Studio units averaging $4,283, 1-Bedroom units at $6,156, and 2-Bedroom units at $8,427. Sky's rental trends show that all layouts (Studio, 1B1B, 2B2B) peaked around mid-2025 and have since declined steadily. The downturn is especially notable for 2B2B units, which experienced the sharpest fall. Despite the recent softening, current prices are still above their 2024 levels. With 9 studio transactions and 8 two-bedroom deals last month, Sky maintains strong activity across unit types while offering increasingly competitive pricing.

How NYC Rent AI Can Help You Find Your Perfect Manhattan Apartment

Our NYC Rent AI Assistant uses advanced artificial intelligence to analyze thousands of Manhattan rental listings, price trends, and building reviews to find your perfect NYC apartment match. Unlike traditional apartment search methods, our AI rental assistant learns your preferences, budget constraints, and must-have amenities to deliver personalized Manhattan apartment recommendations that truly match your needs.

Whether you're looking for a luxury high-rise on the Upper East Side, a pre-war gem in the West Village, or a sleek modern apartment in Midtown, our NYC Rent AI can filter through the noise of the Manhattan rental market to find hidden gems and special offers that manual searches might miss.

NYC Rent AI FAQ:

Q: How does the NYC Rent AI Assistant work for Manhattan apartments?

A: Our AI analyzes real-time Manhattan rental data, price trends, and building reviews to provide personalized apartment recommendations based on your specific needs and preferences.

Q: Can NYC Rent AI find me no-fee apartments in Manhattan?

A: Yes! Our AI specializes in identifying broker-fee-free buildings and special rental offers throughout Manhattan neighborhoods including Upper East Side, Midtown, Financial District, and more.

Q: How accurate are the Manhattan rent prices in your AI report?

A: Our Manhattan rental price data is updated weekly using real-time listings and recent transactions, providing one of the most accurate pictures of the current Manhattan rental market.

More NYC Area Rental Market AI Reports